Welcome to the

Bitcoin Economy

Compliant BTC treasury solution & BTC yield marketplace

for institutions powered by miners.

Trusted by financial pioneers and innovators

BTC Uprising

From Store of Value

To Productive Capital

BTC adoption by corporations worldwide is fueling demand for compliant treasury yield solutions.

$146B

US Corporate BTC sitting idle

$4.3T

US Corporation Cash Holding

86%

Institutions plan to buy BTC

The Rise of a Bitcoin Global Capital Market

Market perspective from finance industry leaders

“I look at Bitcoin as digital gold … a legitimate instrument every portfolio should examine.”

Larry Fink

CEO, BlackRock

“The next growth phase of the digital‑asset industry will be driven by institutional adoption.”

Aaron Schnarch

CEO Advisor, Anchorage

“We believe in the long‑term potential of digital assets both as an investment and also as a liquid alternative to cash.”

10k-filling

Tesla

Platform Benefits

Put institutional BTC to work

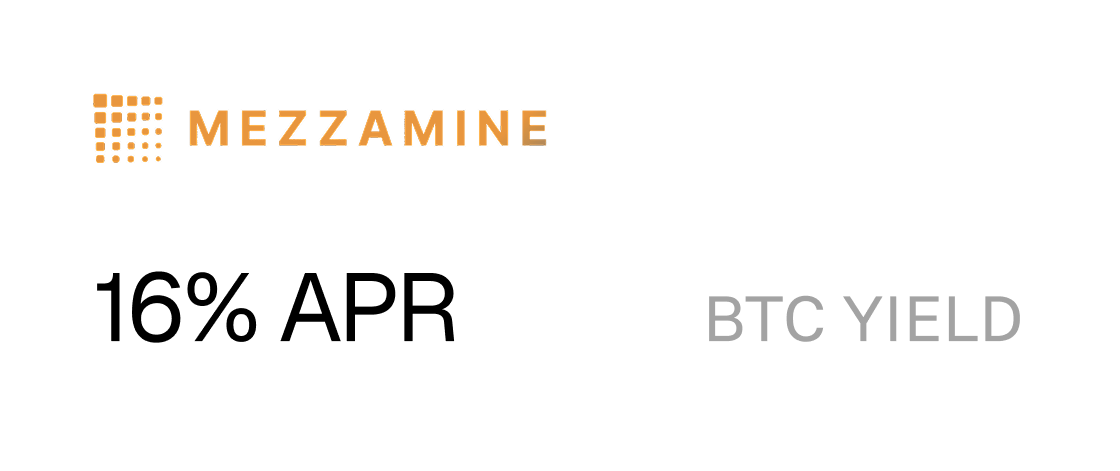

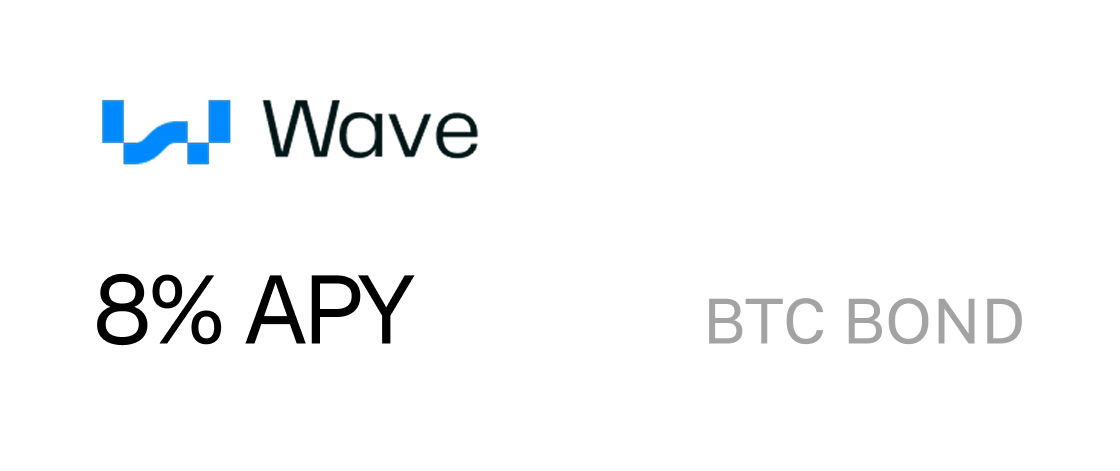

Bitcoin yield products purpose-built for institutions. Access compliant and risk-based BTC instruments with Maestro

* Estimated potential program terms. Actual yields, rates, and terms are partner and market-driven and may vary by program

Institutional-ready

Bitcoin Infrastructure

Maestro enables traditional finance to deploy compliant & permissioned Bitcoin financial services at scale.

Launch Bitcoin-native Financial Products

Transforming the way you manage Bitcoin on the balance sheet. The ultimate solution for Bitcoin treasury management strategies tailored for your needs.

Projected Gross Revenue (USD)

Loan Amortization

* Estimated potential program terms. Actual yields, rates, and terms are partner and market-driven and may vary by program

Strategic

Ecosystem Partners

Strategic partnerships with best-in-class providers across the Bitcoin financial infrastructure stack.

Institutional wealth digital asset management

ASSET MANAGER

ASSET MANAGER

Institutional wealth digital asset management

BTC-native yield via mining lending marketplace

MINING LOAN

MINING LOAN

BTC-native yield via mining lending marketplace

Texas based oil, gas and bitcoin mining company

BITCOIN MINER

BITCOIN MINER

Texas based oil, gas and bitcoin mining company

Secured offchain lending platform for miners

MINING LOAN

MINING LOAN

Secured offchain lending platform for miners

Institutional KYC/AML and exploit insurance

COMPLIANCE

COMPLIANCE

Institutional KYC/AML and exploit insurance

Fixed-rate lending protocols and yield vaults

YIELD PRODUCT

YIELD PRODUCT

Fixed-rate lending protocols and yield vaults

Institutional custody and key management

CUSTODY SOLUTION

CUSTODY SOLUTION

Institutional custody and key management

Yield vaults with automated risk-adjusted strategy

RISK MANAGEMENT

RISK MANAGEMENT

Yield vaults with automated risk-adjusted strategy

Bitcoin Corporate

Treasury Manager

Bitcoin treasury onchain wealth management engine. The operating system for structured BTC financial products.

Bitcoin Yield

Vault Manager

Automate Bitcoin investment strategies and portfolio management. Institutional-grade vaults that connect to custodians and miners.

Bitcoin Miner

Lending Marketplace

Purpose-built Bitcoin intent-based execution engine. The operating system for structured BTC financial products.

Trusted by Leaders

in Bitcoin Finance

Join the institutions building the future of Bitcoin-native finance.

An institutional-grade platform for Bitcoin treasury management and on-chain finance, enabling corporations and asset managers to put their idle Bitcoin to work.

Corporations, asset managers, Bitcoin custodians, and miners seeking to manage, and earn compliant yield on, their Bitcoin treasuries.

Maestro is Bitcoin-native and active 24/7. • vs. ETF: ETFs only trade during market hours and settle in days (T+1). Maestro operates 24/7 with near-instant, on-chain settlement. • vs. wBTC: wBTC is a 'synthetic IOU' that relies on a centralized custodian. Maestro allows you to use your actual BTC, eliminating counterparty and bridging risk*. *Bridging risk refers to the security and trust vulnerabilities that arise when moving assets between blockchains, common in staking protocols.

It means all financial transactions settle directly on the Bitcoin blockchain using actual BTC. This avoids the counterparty and technical risks of wrapped assets or bridges.

Maestro is non-custodial. Your assets remain secure with your preferred institutional custodian. Our platform simply integrates with their existing security (like MPC and policy controls) to execute your approved instructions.

Our vaults are configured to your firm’s compliance requirements, including BSA/AML monitoring and reporting, so you can access on-chain yield while maintaining institutional risk and regulatory standards. Maestro will never receive, request, or store information about your customers or accounts.

Maestro is a technology provider (SaaS). We provide the software, and our platform connects with regulated partners (like qualified custodians and registered asset managers) for compliance with KYC and BSA/AML rules and regulations.

1. Treasury Manager: An operating system to manage your BTC and automate strategies. 2. Yield Vaults: A marketplace for automated, risk-adjusted yield strategies. 3. Miner Lending: A primary yield source connecting institutional capital with vetted Bitcoin miners.

Our primary yield comes from lending BTC to credit-assessed Bitcoin Miners. Certain loans carry borrower default risk and potential loss of principal investment. Maestro partners with specialized firms covering miner underwriting, asset collateralization, and derivatives to ensure maximum loss protection through miner and deal underwriting, BTC and off-chain asset collateralization, and hedging models informed by default risk, Bitcoin price and energy markets.

The Future of Finance

Infrastructure

Come onboard the Bitcoin global capital market

© 2025 Go Maestro Inc. All rights reserved.